The trend of high-end beauty cosmetics is obvious, and pearlescent pigments help to create "perfect makeup"

This year’s Mid-Year Promotion "618" has been launched. Compared with previous years, the involution of the platform has become more heated, the "pre-sale" has been cancelled in rules, the promotion methods have been simplified, and the major platforms have returned to users to increase the profits for consumers. This year’s GMV is expected to go up to a higher level, and cosmetics, as an important sales category, are expected to achieve a significant increase in sales.

In 2023, the GMV of the "618" whole network reached 798.7 billion yuan, and the GMV contributed by the four major e-commerce platforms in the beauty field alone exceeded 61 billion yuan. Some domestic beauty brands are riding the dust, and they can still show the competitiveness of domestic beauty under the encirclement of a number of international brands. China’s cosmetics market has great potential, and domestic beauty cosmetics are gradually moving closer to international brands after industry integration, showing a new development trend.

The trend of high-end domestic cosmetics is obvious.

The overall scale of China’s beauty market is increasing. According to the data of Jost Sullivan, from 2017 to 2022, the market scale of China’s beauty industry increased from 367.9 billion yuan to 552.2 billion yuan, corresponding to CAGR of 8.5%. In 2022, affected by the epidemic, the growth rate decreased by -7.1% year-on-year, but it did not change the overall trend. It is estimated that it will continue to grow at a compound growth rate of 8.2% from 2022 to 2027, reaching 858 billion yuan in 2027.

At the same time, according to the research of Insight Report on Digital Trend of High-end Beauty Market in China, although the beauty market in China suffered a slight setback in 2022, the "lipstick effect" of the beauty industry still holds. After careful observation, we can find that the slowdown of industry growth is driven by the reduction of purchase quantity in the objective environment, and the unit price of customers has not been hit hard, and the trend of consumption upgrading will continue.

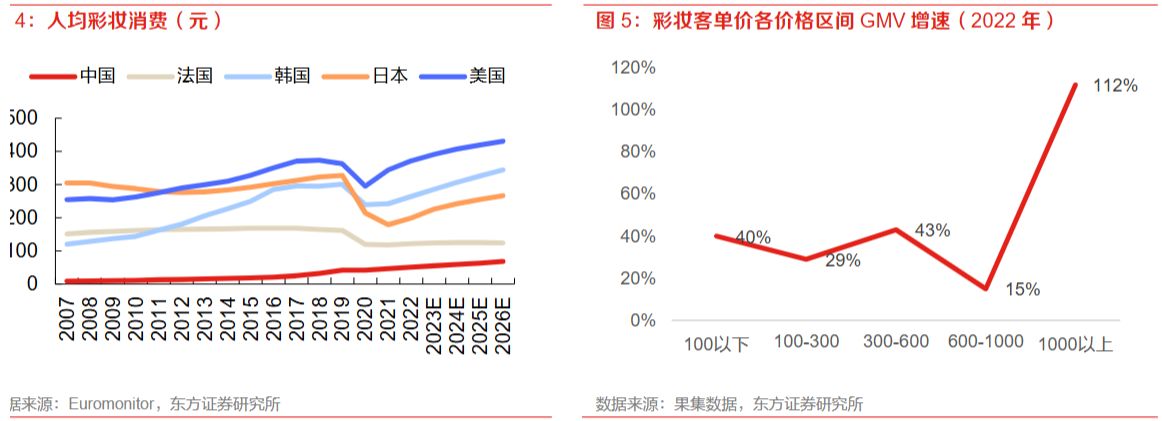

In 2022, China’s per capita consumption of cosmetics was 79 yuan, and it is expected to rise to 116 yuan in 2027, with a significant increase in per capita consumption. In terms of customer unit price, in 2022, the growth rate of GMV of social media e-commerce products with customer unit price above 300-600 yuan /600-1,000 yuan /1,000 yuan was 43%/15%/112% respectively, and the products with high customer unit price had the fastest growth rate. Referring to the per capita consumption of cosmetics in Western Europe, Japan, South Korea and the United States, there is still much room for improvement in the per capita consumption of cosmetics in China.

Judging from the scale of the high-end beauty market, according to Jost Sullivan’s data, the market scale of China’s high-end beauty industry will increase from 116.9 billion yuan to 182 billion yuan from 2017 to 2022, corresponding to CAGR of 9.3%. It is estimated that it will continue to grow at a compound growth rate of 10.2% from 2022 to 2027, reaching 295.7 billion yuan in 2027. The growth rate of the market scale is higher than that of the mass beauty market, and the trend of high-end beauty is obvious.

Domestic beauty brands have also accelerated their reshuffle due to the intensification of competition. With the gradual decline of capital and flow, the weight of product quality in brand growth will increase, from focusing on marketing to paying more attention to research and development and innovation. This also means that the formula and raw materials of beauty products will be more and more important, and high-end raw material suppliers will usher in opportunities with the transformation of domestic beauty products.

Pearlescent pigment meets the needs of high-end beauty cosmetics

The industry divides cosmetic raw materials into matrix, general additives and cosmetic active ingredients. Among them, the matrix is divided into oil, powder, water agent and surfactant; General additives are divided into colloid, antioxidant, preservative, perfume and pigment; Active ingredients can be divided into sunscreen, moisturizing, whitening, oil control, skin rejuvenation, wrinkle removal and so on.

Pearlescent pigment is a kind of special optical effect pigment. When sunlight hits the surface, it produces multi-level refraction, and the interaction of reflected light produces color, which is similar to the principle of rainbow formation. Pearlescent pigment can provide unique luster for cosmetics, increase color levels and help products enhance color effects and visual effects; Take the powdered eye shadow as an example, the pearlescent pigment component accounts for about 10%. With the high-end trend of domestic beauty brands, the demand for pearlescent pigments will continue to increase in the future.

On the one hand, high-end beauty products often pursue more outstanding visual effects and unique texture. Pearlescent pigment can give the product a delicate, bright and layered luster, which makes the beauty show advanced texture and charm; If added to eye shadow, blush and other products, it presents advanced three-dimensional sense and gloss, making the makeup look more refined and luxurious, which meets the high standard requirements of high-end appearance.

On the other hand, high-end beauty cosmetics have higher requirements for color accuracy, stability and innovation. High-quality pearlescent pigments can provide bright, pure and lasting color expression, and can create novel and unique color effects through different blending and combinations, and create innovative beauty concepts and styles, such as using pearlescent pigments to create futuristic or artistic makeup, which is in line with the pursuit of quality and innovation of high-end cosmetics.

Unique visual effect, improving product quality, rich and varied colors, flexible design, adaptability to various scenes, and healthy and environmentally friendly products are all advantages of pearlescent pigments selected by high-end cosmetics brands. In recent years, the market scale of cosmetic pearlescent pigments has grown steadily, which is one of the most promising segments of pearlescent pigments. According to Jost Sullivan’s prediction, the market scale of cosmetic pearlescent pigments will increase by 21.7% from 2022 to 2025.

Domestic pearlescent pigment manufacturers show their talents.

Cosmetic-grade pearlescent pigments are also high-end products in pearlescent pigments industry, which have a high technical threshold. In the past, the global share was mainly in the hands of international enterprises such as BASF, Merck and CQV. However, with the continuous accumulation of technology by domestic pearlescent pigment enterprises, this situation has been broken, and a few leading enterprises have begun to participate in the supply chain of high-end markets such as cosmetics and automobiles, and gained a place in the global pearlescent pigment industry competition.

Global New Materials International (06616.HK) is the leading pearlescent pigment in China. Its greatest technical advantage is its mastery of the whole set of core synthetic mica production technology, which is also a sign that enterprises in the industry have entered the high-end production capacity. Synthetic mica is the main substrate of pearlescent pigments, and synthetic mica-based pearlescent pigments are mainly used in high-end markets such as automobiles and cosmetics. By the end of 2023, Global New Materials International has provided more than 2,000 kinds of pearlescent pigment products, including more than 900 kinds of synthetic mica-based products, and the revenue proportion of high-end products exceeds 50%.

Thanks to the strong R&D team and continuous R&D investment, the company is at the forefront of the industry in product innovation. The new titanium-free series of pearlescent pigments introduced by Global New Materials International at the press conference in early 2024 is the first of its kind in Global New Materials International, including the series of "Jade and Silver Cosmetics" and the series of "Tiema Jinge", which are especially suitable for cosmetics. The products are mainly based on high-quality natural mica, synthetic mica and glass flake, coated with metal oxide by specific technology, and the color trend is accurately controlled, so as to cast pearlescent pigments with obvious pearlescent effect, rich hue, various particle sizes, and luster ranging from soft to ultra-shiny, and do not contain TiO2 component, which can meet the demand of cosmetic pearlescent pigments without titanium component in European Union and other countries.

The company’s iron-based matte chameleon series effect pigments are also very innovative. Based on synthetic mica, a series of dreamy, colorful products with different role effects are prepared by coating with multi-layer metal oxides and non-metal oxides and precise control. Compared with ordinary pearlescent pigments, matte pearlescent pigments produce softer and smoother effects, presenting a matte appearance, which can be widely used in many fields including makeup and cosmetics. The positioning of "low-key and luxurious" satisfies the pursuit of some high-end consumers for matte high-end colors with more "texture".

Moreover, the synthetic mica powder produced by the company can not only be used to produce synthetic mica-based pearlescent pigments, but also be directly and safely used in cosmetics, which meets the requirements of the foreign product ingredient standard of the Japanese Ministry of Medicine. Synthetic mica functional filler has also become an important source of income for the company, contributing 83.77 million yuan in revenue in 2023, with a year-on-year growth rate of 30%.

According to Jost Sullivan’s data, its market share of pearlescent pigments in 2022 will be the first in China and the fourth in the world by revenue. After the acquisition of CQV in 2023, its global pearlescent pigment market share jumped to the third place, further enhancing its market share. At the same time, the technology empowerment and global channel sharing brought by the acquisition of CQV have greatly enhanced the competitive strength of Global New Materials International in high-end markets such as cosmetics-grade pearlescent pigments and automobile-grade pearlescent pigments.

CQV is a company that mainly produces high-end pearlescent pigments, and it is also an important participant in the international market. More than 80% of its income comes from the sales of automotive and cosmetic products. CQV is the only enterprise in the world that can realize mass production of pearlescent pigment products based on automotive grade alumina. Its cosmetic products are also very competitive in the Asian cosmetics market. The pearlescent pigments based on alumina are bright, shiny, clean and smooth, and are approved to be used in all cosmetics in the world.

With the development of domestic beauty cosmetics, the demand for pearlescent pigments, which can improve the texture and visual effect of products, will inevitably increase. Global New Materials International has the advantages of technology and scale, and is one of the few enterprises with high-end production capacity. The pearlescent pigments developed by it meet the needs of high-end beauty cosmetics and also have advantages in product quality and performance.

At the same time, with the deep integration with CQV and the release of high-end production capacity, it will further enhance its competitive strength, which is expected to help the company seize the transformation opportunity in the beauty field, strengthen its leading position in the cosmetics-grade high-end market, form a virtuous circle, and lay a solid foundation for future sustainable development.

Transfer from: China. com

[Copyright and Disclaimer] All copyrighted works belonging to this website must be authorized to reprint and indicate the source of "China Industrial Economic Information Network". Otherwise, this website will reserve the right to pursue its relevant legal responsibilities. Reprinted articles and corporate publicity information only represent the author’s personal views, not the views and positions of this website. Please contact: 010-65363056 for copyright matters.

Extended reading