Apple Japan supplier: I have been working for 46 years and have never seen such a poor monthly performance.

[Text/Observer Network Xu Ganang]

At the beginning of the year, Apple lowered its revenue expectations, and many suppliers subsequently "thundered".

On the 17th, Nidec, an Apple supplier, made a "double kill" on revenue and profit expectations. The CEO of the company, Yong Shou Chongxin, said that he had seen such a large monthly decline for the first time since he founded the company 46 years ago. He pointed out that China’s economic slowdown led to the deterioration of the business environment, and Sino-US trade friction was one of the main reasons for China’s economic slowdown.

On the same day, Taiwan, China TSMC also held a performance briefing, and it is predicted that the company’s revenue will reach the worst level in 10 years in the first quarter of this year.

According to the Asahi Shimbun, NEC held a press conference to cut its revenue forecast for FY 2019 by about 25%.Became the first time in 9 years (as of March 2010);At the same time, NEC also lowered its revenue profit forecast for 2018 by 13%.For the first time in six years.

NEC was established in 1973. The founder and current CEO of the company, Yong Shou Zhongxin (76 years old), said at the meeting."In the 46 years that I have led the operation, it is the first time that the monthly performance has fallen so sharply … The performance in November and December is simply unusual." He pointed out that China’s economic slowdown led to the deterioration of the business environment, and Sino-US trade friction was one of the main reasons for China’s economic slowdown.

Always keep faith. Photo from Asahi Shimbun

He also said that,Due to weak market demand in China, NEC cut its production capacity for China manufacturers by 30% at the end of 2018.

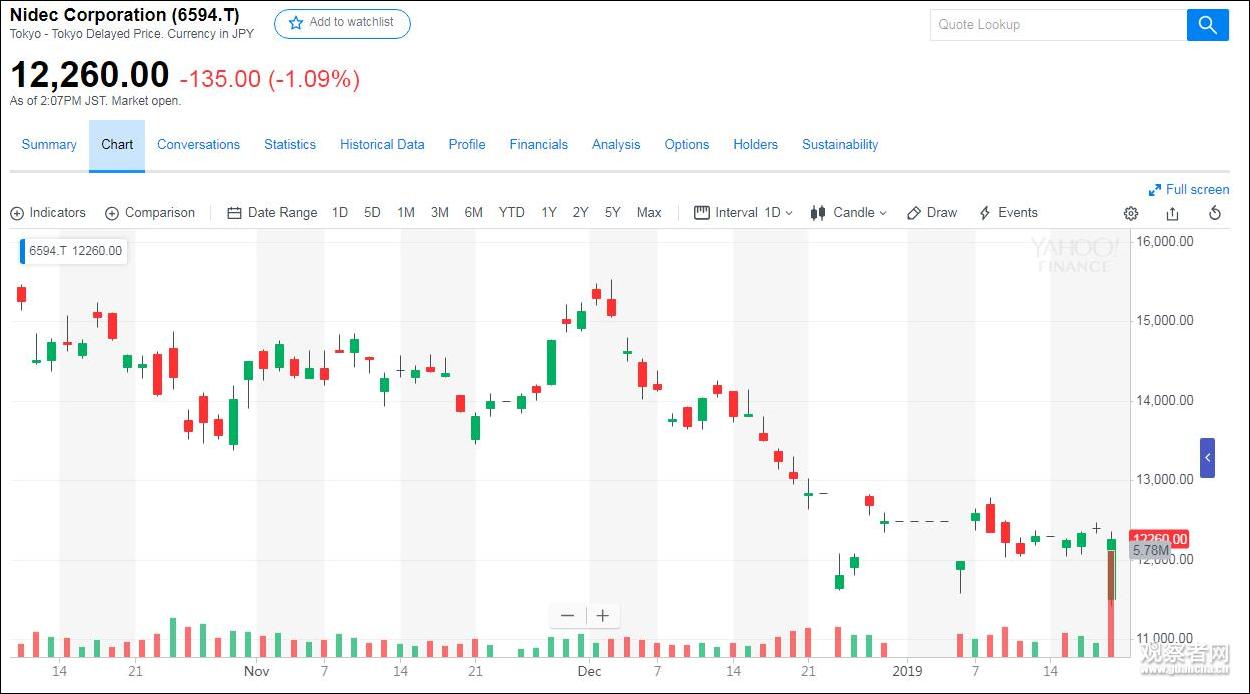

After the news came out, NEC fell more than 7% on the 18th, and as of 2: 07 pm local time, the decline narrowed to 1.09%.

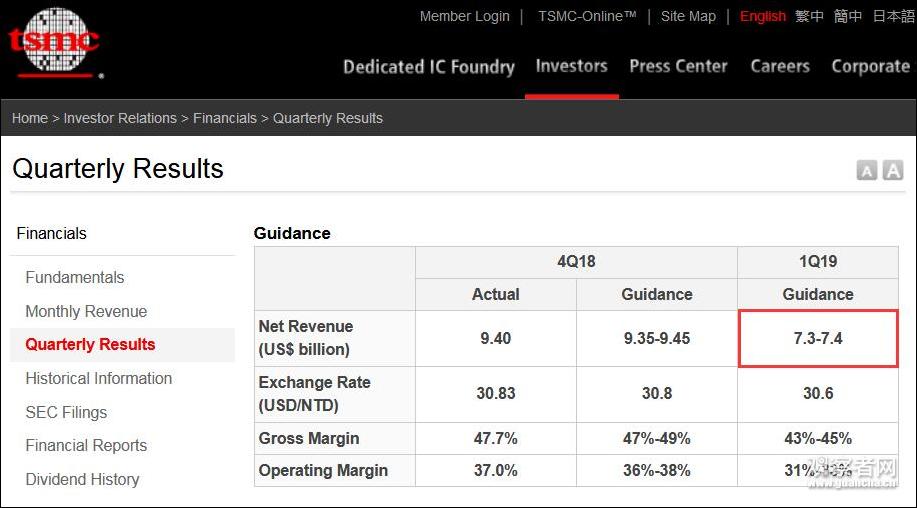

According to the announcement released by TSMC’s official website on the 17th, the company expects its revenue in the first quarter of 2019 to be 7.3 billion to 7.4 billion US dollars.It decreased by about 22% from the previous month.According to the data of Refinitiv (formerly Thomson Reuters Financial Risk Business Department), according to the quarterly report,TSMC is expected to record its worst performance since its revenue plunged by 54% in the first quarter of 2009.

Figure from TSMC

In terms of gross profit margin, TSMC expects the first quarter data to be 43% to 45%. China securities journal pointed out that this is much lower than the market expectation of 47.53%. Specific to the business category, TSMC expects that the consumer business will increase slightly, and the industrial application will decline most obviously. Looking at the whole industry, TSMC expects that the inventory will be digested in the middle of the year, but the market size of Foundry (OEM) is flat.

For the whole year of 2019, TSMC expects revenue growth to be 1% to 3%, less than half of last year’s 6.5%.TSMC said it would reduce its capital expenditure by hundreds of millions of dollars accordingly.

As for the reasons for the decline in gross profit, TSMC spokesperson He Limei mentioned that "the sales of high-end mobile phones are less than expected" and "the demand in digital currency is weakened", which made the company’s 10nm process performance less sustainable. However, while the company’s 10nm business declined, 7nm revenue grew strongly, accounting for 23% in the fourth quarter of 2018 (10nm business accounted for 25% in the fourth quarter of 2017).

On the same day, TSMC’s US stocks opened lower and went higher, closing up 1.8% at $36.29.

It is worth noting that TSMC did not point out that "Apple’s mobile phone demand is weak" in the report of the day.

On January 3rd, Apple announced that it would cut its revenue forecast for the first quarter of 2019, and "dumped the pot" on China’s economic growth. Subsequently, its share price nearly "fell", and its market value evaporated by $74.1 billion in a single day (3rd). Observer Network noted that,The five star technology stocks "FAANG" of US stocks have shown an overall upward trend since 2019, and only Apple has fallen (compared with last year).

Annual k-line

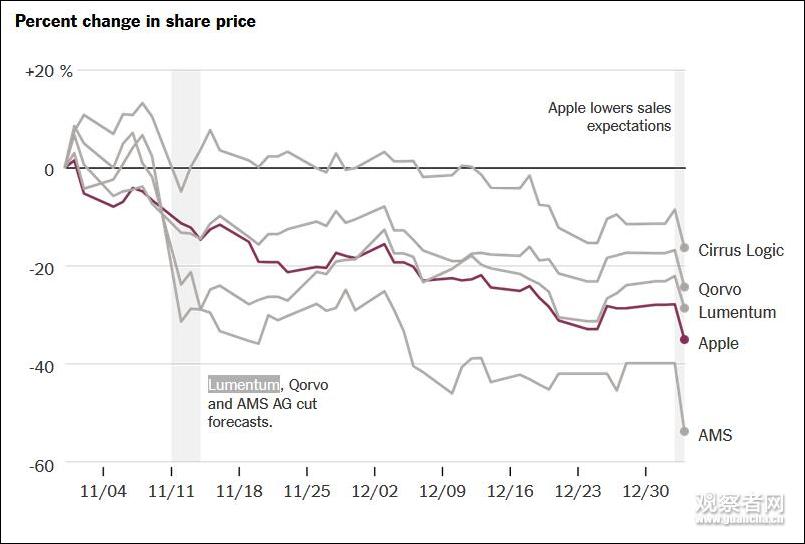

At the end of last year, according to Observer.com, semiconductor manufacturers Qorvo, Cirrus Logic, optical component manufacturer Lumentum, and sensor manufacturer AMS.All four Apple suppliers have lowered their revenue expectations for Q4 2018. As of January 3, these four stocks also broke away from the US stock market’s "continuous rise in the New Year" and followed Apple’s decline.

Compared with the stock price on November 4, 2018, AMS fell by more than 20%.

"Thunderstorm" continues.

On January 9th, Skyworks, an Apple wireless and RF chip supplier, predicted that the company’s revenue in the first quarter of this year would be $970 million, which was lower than the earlier sales target of $1 billion to $1.02 billion. More than half of the company’s revenue is tied to Apple.

On the 14th, Dialog Semiconductor, an apple chip supplier, said that its sales in the fourth quarter of last year reached 431 million US dollars, only exceeding the previous worst expectation of 1 million US dollars. 75% of the company’s business is to provide chips for Apple.

This article is an exclusive manuscript of Observer. It cannot be reproduced without authorization.